MT5 White Label Setup

Launch a fully branded MetaTrader 5 environment with hosted infrastructure, connectivity options, and operational support — built for brokers who want speed to market without compromising reliability.

Typical projects can be structured for a fast launch (subject to third-party approvals and your chosen integrations).

A complete MT5 white label foundation

We package the essential components required for a broker to operate an MT5 environment under their own brand, with clear responsibilities and a practical rollout plan.

Branding & client experience

Branded terminals, logos, colour palette alignment, and download pages that match your brokerage identity.

Hosted infrastructure

Secure, low-latency hosting options in major financial data centres, with monitoring and operational best practices.

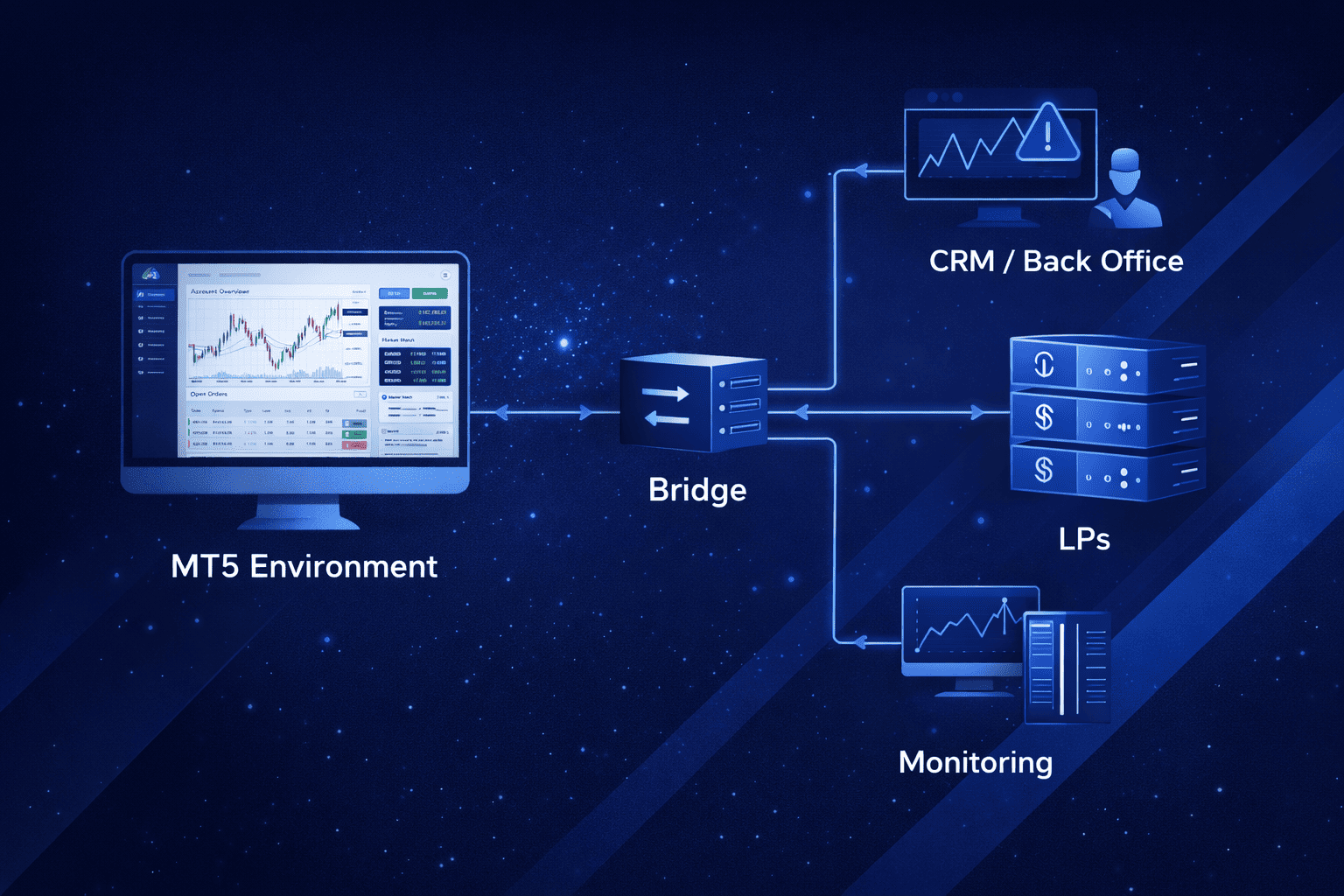

Connectivity & integrations

Connect to your preferred liquidity providers and bridge/aggregation layer, plus CRM/back-office integrations as needed.

Security & access control

Structured roles, environment segmentation, and guidance on operational controls suitable for a brokerage setup.

Operational rollout

UAT checklist, launch runbook, and handover materials so your team can run day-to-day operations confidently.

Path to standalone

When you’re ready, we help plan the transition path (data, processes, and cutover approach) to a standalone license model.

Note: Nexdao is a technology and services provider. Nexdao is not a broker, not a liquidity provider, and does not hold client monies.

Designed for stability, latency, and control

A practical brokerage setup typically includes environment segmentation (production vs. testing), connectivity to your chosen LPs, and monitoring aligned with trading workloads.

Hosting options

Deploy in major financial data centres and select latency-optimised routes based on your client geography and LP footprint.

Connectivity layer

Bridge/aggregation integration with clear routing logic (A-book/B-book policies depend on your business model and compliance).

Want a specific topology? Share your target regions, product list, and expected volumes — we will propose an appropriate layout.

A structured rollout plan

Every brokerage is different. We keep the rollout predictable by locking scope early, using checklists, and validating integrations before go-live.

Discovery & scope lock

Products, target regions, LP/bridge preferences, compliance constraints, and branding assets checklist.

Environment provisioning

Hosting allocation, baseline hardening, access roles, and initial configuration suitable for testing.

Branding & client deliverables

Terminal branding, download assets, basic landing pages, and operational documentation for support teams.

Liquidity & integration

LP connectivity, symbol configuration, pricing/markup logic (as agreed), plus CRM/back-office/payment/KYC integrations if required.

UAT, launch & hypercare

UAT sign-off, go-live window, monitoring, incident playbook alignment, and post-launch stabilisation period.

What we need from you

Brand assets (logo, colours), product list, desired account types, target regions, compliance requirements, and your LP/bridge preferences (if already chosen).

What you get at handover

Operational runbook, environment access matrix, configuration summary, and a maintenance/support plan aligned to your business hours and SLA.

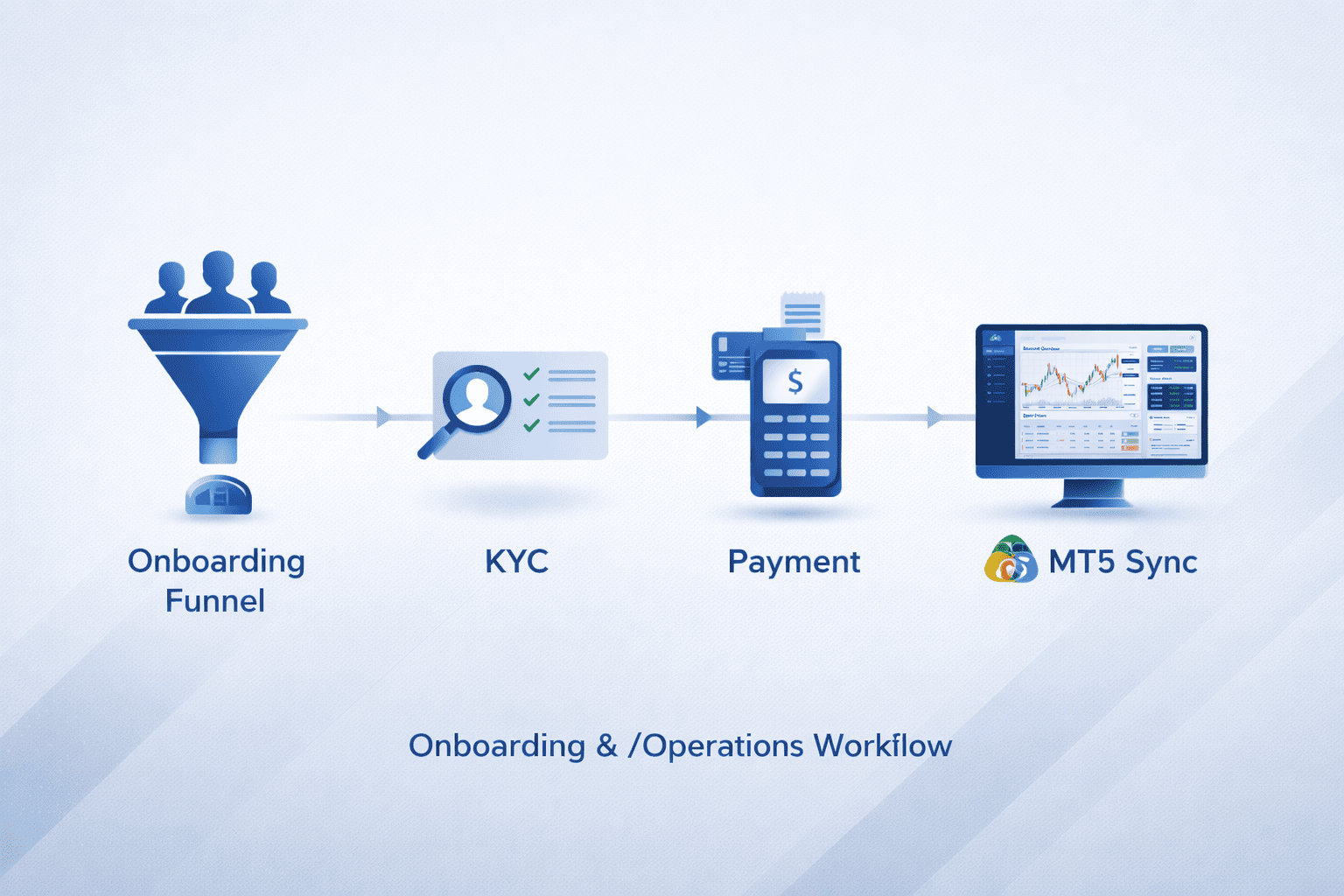

Add the components your brokerage needs

Start lean, then layer in the tooling that improves conversion, compliance workflows, and operational efficiency.

CRM & back office

Lead management, onboarding workflows, IB management, reporting, and retention tooling — integrated to your MT5 operations.

Payments & PSP routing

Deposit/withdrawal flows, reconciliation, and configurable payment routing (subject to your regulatory model and providers).

KYC/AML workflow

Document collection, verification integrations, risk scoring, and case management aligned with your compliance policy.

Integrations we commonly see

We can integrate based on what you already use — or propose options based on your target regions.

- Liquidity providers and market makers (your choice)

- Bridge / aggregation layer (your choice)

- CRM & client portal (optional)

- KYC verification and document storage (optional)

- Payment service providers and reconciliation (optional)

- Website tracking, analytics, and conversion tooling (optional)

Common questions about MT5 white label

How long does it take to launch?

A fast launch can be planned in weeks for a core setup, but timelines depend heavily on third-party approvals, integration choices, and how quickly branding/compliance inputs are provided.

Can we use our own liquidity providers?

Yes. We can work with the liquidity provider(s) you choose, subject to the technical integration approach and your contractual/compliance requirements.

Do you provide compliance or licensing?

We can advise on operational requirements and introduce partners where appropriate. Licensing and legal compliance are jurisdiction-specific and should be handled with qualified legal/regulatory advisors.

What’s included in ongoing support?

Support can include monitoring, incident response coordination, configuration changes, and platform maintenance. The exact scope is defined in your support plan and SLA.

Can we transition from white label to standalone later?

Yes. Many brokerages start as a white label to validate product-market fit, then plan a staged transition to a standalone model when operational readiness and volume justify it.

Need a tailored quote? Send your requirements (regions, instruments, expected volumes, LP/bridge preferences) and we’ll respond with a practical scope.

Talk to Nexdao about your MT5 launch

Share your business model (target regions, instruments, and onboarding approach). We’ll outline a rollout plan, required inputs, and a realistic timeline.

Quick checklist

- Brand kit: logo + colours

- Target regions + client profile

- Product list (FX/indices/commodities/crypto CFDs, etc.)

- LP / bridge preferences (if any)

- CRM/KYC/payment requirements

Disclaimer: Nexdao is a technology and service provider. Nexdao is not a broker nor a liquidity provider and does not hold client monies.